The emergence of DeepSeek, a Chinese artificial intelligence (AI) startup, has sent ripples through the U.S. tech stock market. By unveiling DeepSeek-R1, an open-weight AI model offering cutting-edge capabilities at a fraction of the cost of major players like OpenAI, DeepSeek has disrupted market dynamics in ways few anticipated. Investors, traders, and analysts alike are now grappling with the broader implications of this development – particularly its impact on investor sentiment, trading patterns, and overall market volatility.

A Shift in Investor Sentiment

DeepSeek’s strategy challenges conventional wisdom that AI development necessitates colossal resources. While DeepSeek-R1 isn’t fully open-source, its “open-weight” model provides public access to specific components, fueling innovation and lowering entry barriers. This shift has sparked excitement among developers and researchers but has also unsettled investors concerned about U.S. AI leadership. The repercussions were swift: a notable downturn in tech stocks, with traders reassessing the valuation of AI-driven enterprises.

Disrupting Trading Patterns

DeepSeek’s introduction of cost-efficient AI solutions has triggered widespread sell-offs in major tech stocks. Hedge funds, traditionally reliant on well-established AI firms, found themselves caught off guard. Goldman Sachs reported a 1.1% drop in hedge fund performance – significant given that annual gains typically hover around 15%. BarclayHedge estimates potential losses in the billions. Nvidia, a cornerstone of AI-driven investments, suffered a staggering 17% decline, erasing nearly $600 billion in market capitalisation. Meanwhile, systematic traders, who leverage algorithmic strategies, reaped benefits, recording gains of 1.7% by shorting overvalued assets early in the downturn.

Heightened Market Volatility

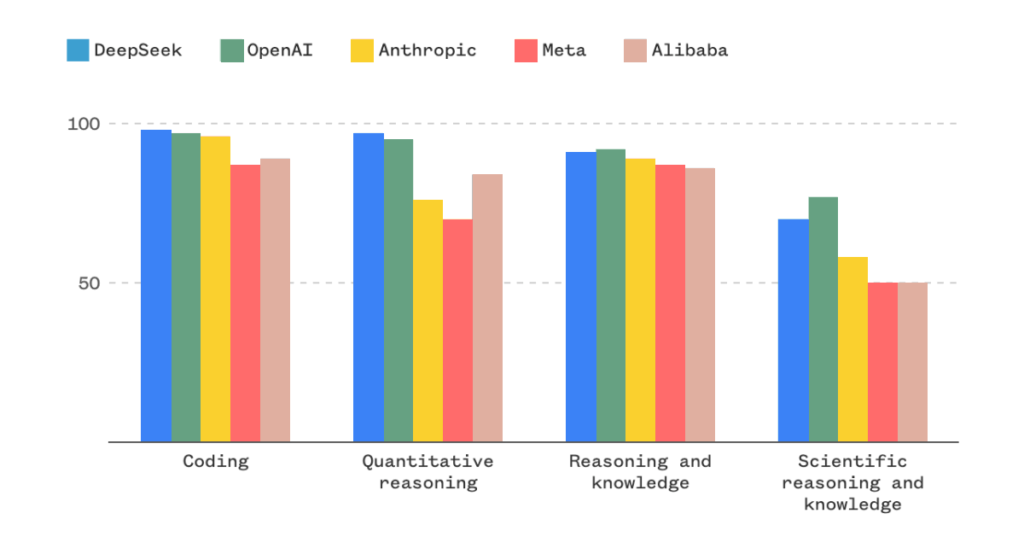

DeepSeek’s technological strides have prompted comparisons to historical inflection points – some even calling it a “Sputnik moment” for AI. Its R1 model demonstrates capabilities rivaling OpenAI’s latest iterations in key areas like mathematics, coding, and natural language processing. As market participants digest the implications, uncertainty has fuelled volatility, amplifying swings in stock prices. The shake-up underscores how AI breakthroughs can reshape financial landscapes in unexpected ways.

The Future of AI in Investment Strategies

DeepSeek’s disruptive entry underscores the growing influence of AI-driven financial tools in shaping investment strategies. By offering high-caliber AI capabilities at a fraction of traditional costs, DeepSeek is leveling the playing field, enabling a broader spectrum of investors to harness AI-driven insights. This democratization of financial analytics could foster more efficient markets, reducing information asymmetries and enhancing decision-making processes.

In Summary

DeepSeek’s ascent marks a turning point in the AI investment landscape. Its innovative approach has already left an indelible mark on the U.S. tech stock market, altering sentiment, shifting trading patterns, and intensifying market volatility. As AI-driven financial tools continue to evolve, their role in shaping tech investments is only set to grow – heralding a new era of market dynamics powered by artificial intelligence.